We help organizations classify their products and understand and comply with export requirements.

by Toni Paytas, Partner (retired), Thomsen and Burke LLP

Introduction

Classification of products and technologies is one of the most important decisions in all of trade compliance. Export classification is essential to ensuring that the licensing requirements are met. Import classification is important to ensuring that the least possible duty is paid. This issue brief focuses on export classification.

The classification of an item often determines whether that item requires a license for export to a particular destination. An incorrect classification can lead to a failure to obtain the required export licenses, or to the submission of license applications that are unnecessary. Export classification involves more than a comparison between product characteristics and control list parameters. In some cases, the classification of a product may be different from the classification of the underlying technology. The classification of the underlying technology is important for exports to offshore manufacturing partners, offshore development partners, foreign subsidiaries, and your own foreign person employees (deemed exports). If you would like to learn more about offshore manufacturing then take a look at this Gembah article – it helps explain these things in more detail. We help clients determine the correct classification not only for their products but also their technologies.

Commerce Department

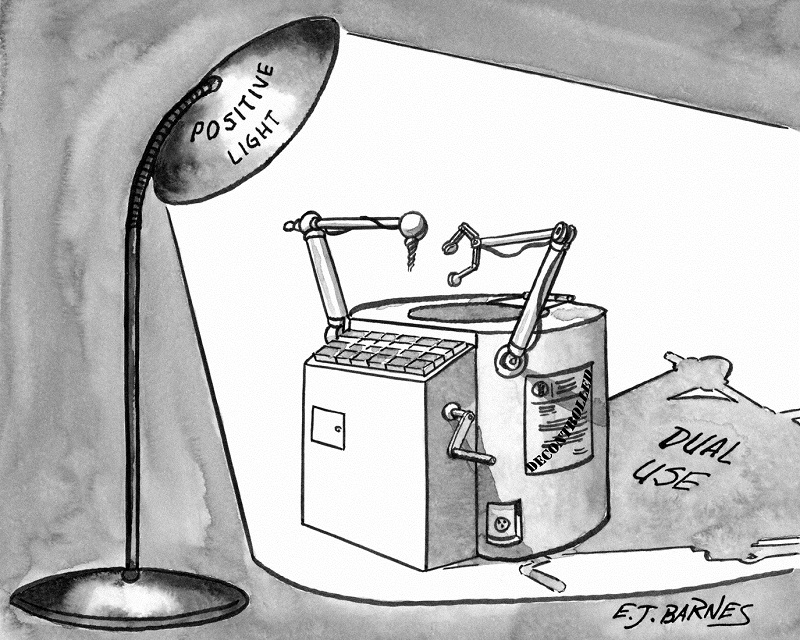

The Commerce Department has jurisdiction over “dual-use” items, i.e., items that having both military and civilian applications. These items are described on the Commerce Control List (CCL) of the Export Administration Regulations (EAR).

Classification of “dual use” items requires not only detailed knowledge of the item being classified, but also of the nomenclature and taxonomy of the CCL. Frequently, the same term can have different meanings, in industry parlance as opposed to government regulations. Our experience with a variety of industries and technologies (e.g., telecommunications and networking, semiconductors and semiconductor manufacturing equipment, biomedical, encryption products, aerospace and defense) means clients do not need to spend time explaining their products and technologies to us. Our lawyers “speak geek” and are quite comfortable conversing with scientists and engineers. These conversations significantly improve the speed and quality of the classification determination.

With the exception of products that include or use encryption, most items on the CCL are eligible for self-classification. We assist clients by determining and documenting the rationale for the most favorable classification. Examples of items classified under an Export Control Classification Number (ECCN) include:

- ECCN 1C351 for certain genetically modified organisms and genetic elements;

- ECCN 3A001 for certain integrated circuits and other electronic components;

- ECCN 5A001 for certain telecommunications and networking equipment;

- ECCNs 5A002 and 5D002 for certain items incorporating encryption; and

- ECCNs 6A003 and 6A005 for certain imaging equipment, cameras and lasers.

Exporters also have the option of obtaining a formal classification (CCATS) to validate their self-classification. A formal classification can useful to share proactively with foreign governments for import purposes, to share with customers, distribution partners, and potential investors, and to utilize defensively with enforcement agents during investigations.

Preparing a formal classification request is an art. The challenge is to provide just the right information to optimize the likelihood of the most favorable classification, keeping in mind that in order to be valid, the application must be accurate and complete in all material respects. Submission of the classification request is not the goal – obtaining the most favorable classification wins the prize.

State Department

The State Department has jurisdiction over military and intelligence items under the International Traffic in Arms Regulations (ITAR). These include “defense articles” and “defense services” described on its United States Munitions List (USML). Some items on the USML are classified as significant military equipment (SME) and are subject to additional export licensing requirements, because of their capacity for substantial military utility or capability.

In recent years, the USML has been undergoing amendments pursuant to the Export Control Reform initiative, resulting in a more “positive list” that describes controlled items using, to the extent possible, objective criteria rather than broad, open-ended, subjective, or design intent-based criteria. As a result of these efforts to create a “positive list”, some items formerly on the USML have moved to the jurisdiction of the Commerce Department.

Oftentimes, the key to proper classification is understanding the penumbra of the specific item subject to control, and the provenance of the client’s technology. The grey areas between technologies that were developed initially for military application, but since have transitioned to dual use, present some of the more challenging classification determinations.

Treasury Department

The Treasury Department generally relies on other agencies for classification determinations. It relies on the Department of Commerce for items subject to the EAR. It relies on the Departments of Agriculture and the Food and Drug Administration for classifications of agricultural commodities and medicine under the Trade Sanctions Reform and Export Enhancement Act of 2000. In the case of certain medical supplies, the Department of Treasury has published a list of items qualifying for such classification. However, Treasury generally speaking has a smaller supply of technical experts than the other agencies, so extra care must be taken to ensure that a particular product or technology is classified accurately in order that export licenses can be processed quickly by Treasury.

Conclusion

Thomsen and Burke’s goal is to assist clients in getting it right the first time so that future actions based on the classification determination do not cause export violations. In some cases, self-classification is appropriate and we assist clients in the review and documentation to support a self-assessment. In other cases, a formal ruling may be necessary or desirable. We assist clients in preparing the documentation necessary to support our goal of obtaining the most favorable classification for a given product or technology.

Disclaimer: This document may be considered Attorney Advertising. It is provided for informational purposes only and is not to be considered legal advice. Its distribution does not establish an attorney-client relationship. Each situation is unique and the techniques used will differ depending on the facts and circumstances. Therefore, this document does not describe the work that may performed in any particular matter.