by Toni Paytas, Partner (retired), Thomsen and Burke LLP

We provide on-site compliance audits and help design and implement organization-wide compliance programs.

Introduction

Thomsen and Burke LLP’s Gap Analysis and Audit Program provides our clients with a focused methodology for assessing the state of their compliance with laws and regulations governing international trade. The end result is a series of prioritized recommendations with respect to the design and implementation of a Trade Compliance Management Plan (TCMP) or enhancement of an existing TCMP.

“We help clients balance risks/rewards with the available resources.”

– Toni Paytas

Field Work

A typical review begins with our review of the client’s existing policies and procedures. We start by reviewing with any existing policies and procedures related to trade compliance. In addition, we also review policies and procedures related to engineering, product management, order entry, human resources, and other business functions that may perform important, but discrete, roles in the company’s international trade activities. The second step typically involves reviewing a representative sampling of transactions. The third step typically involves conducting interviews of key personnel responsible for trade compliance and these discrete business functions.

Review Methodology

We then compare the findings of the field work against five sets of guidelines: (1) the Export Management Compliance Program Guidelines promulgated by the Commerce Department’s Bureau of Industry and Security, (2) the Compliance Program Guidelines promulgated by the State Department’s Directorate of Defense Trade Controls, (3) the Best Practices Guidelines set forth in the so-called the Nunn-Wolfowitz Task Force Report – Industry “Best Practices” Regarding Export Compliance Programs, (4) the Wassenaar Arrangement’s Best Practice Guidelines, and (5) the Guidelines for an Effective Compliance and Ethics Program set forth in the revised Federal Sentencing Guidelines.

Recommendations

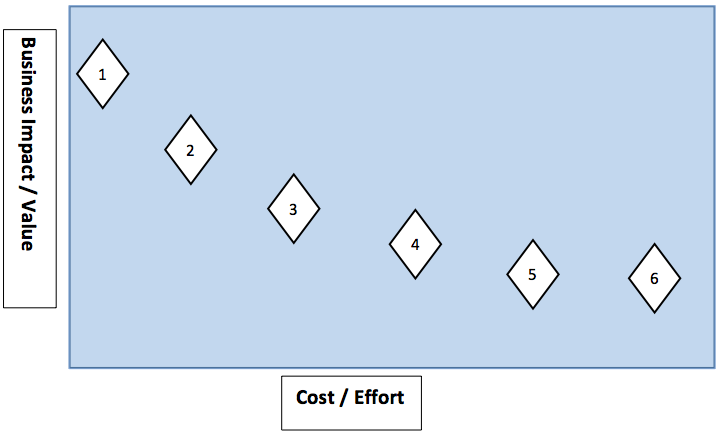

Next, we formulate recommendations that we graph against two axes. The horizontal axis represents the relative implementation cost. The vertical axis represents the relative compliance benefit.

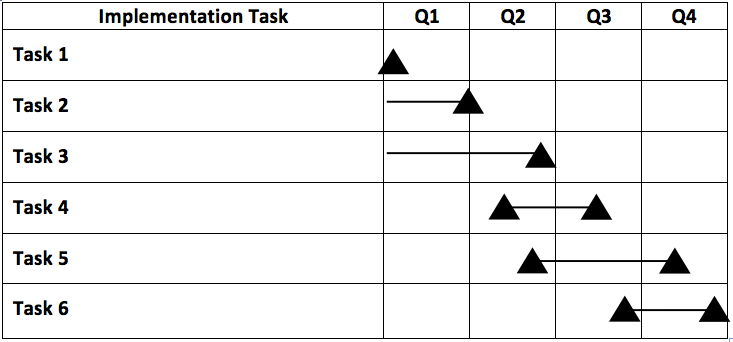

From this graph, we can prioritize the TCMP implementation tasks, beginning with tasks that are relatively lower cost with higher benefit, and (time and resources permitting) to tasks that are relatively higher cost with lower benefit.

Conclusion

Our Gap Analysis and Audit Program can be scaled to fit the budget, business profile, and other requirements of your enterprise. The TCMP’s recommendations can be implemented, over time, based on priorities and business constraints. Our clients generally tell us that the net result is a valuable “snapshot” of their compliance profile, and a “roadmap” to responsible risk management going forward.

Disclaimer: This document may be considered Attorney Advertising. It is provided for informational purposes only and is not to be considered legal advice. Its distribution does not establish an attorney-client relationship. Each situation is unique and the techniques used will differ depending on the facts and circumstances. Therefore, this document does not describe the work that may performed in any particular matter.